I have nothing to add.

Believe in Liberty. Think for youself. But listen to me. - T.T. Buffett, Investment Linebacker -Tu Ne Cede Malis

Wednesday, February 17, 2010

Sunday, February 14, 2010

Harrisburg. Pennsylvania Makes Official Its March Toward Default

As we discussed last week, Pennsylvania's state capitol city - Harrisburg - is insolvent. This week, Harrisburg makes it official by passing a budget that excludes paying their financing obligations. Chapter 9 feels right around the corner...

Reuters provides the story. Article included below [emphasis and comments added]:

Reuters provides the story. Article included below [emphasis and comments added]:

PHILADELPHIA, Feb 14 (Reuters) - Harrisburg, Pennsylvania, moved a step closer to defaulting on a bond payment when its city council passed a 2010 budget that does not include $68 million in debt repayments on an incinerator.

Without the debt provision in the $65 million budget, the state capital may miss a March 1 payment of $2.072 million, a rarity for a municipal bond issuer. [TILB: a "rarity" indeed, although we suspect that like homeowner mortgage default, this will become less rare over the next few years]

Joyce Davis, a spokeswoman for Mayor Linda Thompson, confirmed the council's decision -- taken at a special session on Saturday -- and said the mayor is not commenting for now on the implications of exclusion of the debt payments from the budget.

The council also defeated a plan to sell city assets to help pay down the debt which is guaranteed by the city on behalf of the Harrisburg Authority, a separate municipal entity that owns the incinerator. Council members also rejected Thompson's plan to raise property taxes and water rates.

The $2.072 million payment is the latest installment on a $300 million bond owed on the construction of the incinerator. An additional $637,000 is due on April 1.

City Controller Dan Miller said last year's payments on the incinerator were made from a debt service reserve fund that is now depleted.

Debt payments on the incinerator total $68 million in 2010, or more than the city's general fund budget of about $60 million, Miller said.

Miller said on Feb. 9 he would "not be surprised" if Harrisburg fails to meet the March 1 payment.

Asked whether the city may file Chapter 9 bankruptcy as a way to get its debts under control, Miller said that was a "possibility."

The tax-exempt municipal bond market, which states, cities and municipalities use to raise the funds to build roads, schools and hospitals, is viewed as very safe with a far lower default rate than the corporate bond market.

Just 54 municipal bond issuers rated by Moody's Investors Service defaulted on their debt between 1970 and 2009, the agency said on Thursday. The average five-year historical cumulative default rate for investment-grade municipal debt was 0.03 percent in the period, compared with 0.97 percent for corporate issuers.

The recession has raised concerns of an increase in defaults as states, cities and towns struggle to balance budgets as required by law in all states except Vermont.

So far, however, those fears have not been realized and ratings agencies have played down the likelihood of a spike in defaults.

Fitch Ratings in January cautioned cities against using the threat of bankruptcy as a weapon to win concessions from labor unions. Even talk of bankruptcy can become self-fulfilling and undermines investor confidence in the market, it said.

Labels:

bankruptcy,

Chapter 9,

Default Rate,

Harrisburg,

Muni,

Municipalities,

Pennsylvania

Wednesday, February 10, 2010

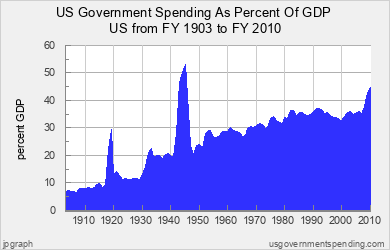

TILB Depressing Chart Of The Day: Government Spending As A Percent Of GDP

This basically speaks for itself. It is all government spending: federal, state and local. The data series can be found here.

Another way to think of this is that 45% of your productive effort goes to supporting The State. While you may say, "but that's impossible because the sum of the average tax rate we pay doesn't get to 45%", then you just figured out what government borrowing allows for.

Paying off that debt (without defaulting) means one or a combination of higher explicit taxes, higher implicit taxes (money printing), or massively reduced government spending in the future. Guess which one of these is unlikely.

If you just vomited in your mouth and subsequently swallowed it, you're not alone.

Another way to think of this is that 45% of your productive effort goes to supporting The State. While you may say, "but that's impossible because the sum of the average tax rate we pay doesn't get to 45%", then you just figured out what government borrowing allows for.

Paying off that debt (without defaulting) means one or a combination of higher explicit taxes, higher implicit taxes (money printing), or massively reduced government spending in the future. Guess which one of these is unlikely.

If you just vomited in your mouth and subsequently swallowed it, you're not alone.

Sunday, February 07, 2010

Pennsylvania's Capital City, Harrisburg, Faces Bankruptcy

Somehow we missed this news during January. Hopefully it continues to develop toward a filing.

Awesomely, Pennsylvania's capital city - Harrisburg - is insolvent and on the brink of filing for Chapter 9 bankruptcy.

As reported in this link to WGAL's website, you can see that Harrisburg's new mayor is dealing with all sorts of tough decisions in her first few weeks in office.

TILB's advice to Mayor Thompson: take a page from Arnold's book and start issuing your own scrip. Seems like s no-brainer.

Emphasis added [and comments added in brackets]

Awesomely, Pennsylvania's capital city - Harrisburg - is insolvent and on the brink of filing for Chapter 9 bankruptcy.

As reported in this link to WGAL's website, you can see that Harrisburg's new mayor is dealing with all sorts of tough decisions in her first few weeks in office.

TILB's advice to Mayor Thompson: take a page from Arnold's book and start issuing your own scrip. Seems like s no-brainer.

Emphasis added [and comments added in brackets]

WGAL.comExpect more of this sort of thing.

Harrisburg Facing Bankruptcy; Mayor Proposes Tax Hike, Leasing Assets

Official: Incinerator Primary Cause Of Financial Woes

HARRISBURG, Pa. -- After just a few weeks in office, Harrisburg Mayor Linda Thompson is facing financial problems that could put the city in bankruptcy before the year is out.

City officials blame the incinerator facility, now over $228 million in debt, for the city's financial troubles.

That's not an option she even wants to consider at this point, but any successful plan must solve the financial drain of the city's incinerator.

The incinerator is currently $288 million in debt and is the primary cause of Harrisburg's financial problems.

Officials said it doesn't begin to produce the revenue needed to pay off the debt of repairing and operating the facility over the years.

Former City Council vice president Dan Miller said it's been a financial drain for decades.

"It's such a problem because for 25 years, the true problem of the incinerator has never been addressed," said Miller. "It's been refinanced repeatedly and pushed down the road, always waiting for someone else to solve the problem."

Now, he said, the city must solve the problem.

Miller said he believes the city should consider going into Act 47, the first step before bankruptcy. That would allow the city to negotiate with the people it owes to come up with realistic plans to settle debts.

Miller said raising taxes and other fees, or selling off revenue-producing city assets like the parking garages and water and sewer operations, will only create new problems.

Mayor Thompson Proposes Budget Amendments

Thompson addressed City Council Tuesday night with her own plans to fix the financial crisis.

City council member Wanda Williams said Thompson's proposed tax hike is "an outrageous amount" to increase any taxes. [TILB - I love this! "We can't cut spending" and "we can't sell our precious assets" and "we can't raise taxes"! Guess what you can do, loser: File BK.]

Thompson is proposing to increase water rates by 40 percent and cut overtime funding for the police and fire department.

At the meeting, Thompson also proposed what she called tough decisions, which include:

A 20 percent property tax increase

Cutting costs for trash collection

Merging Harrisburg dispatch with the Dauphin County 911 center

Thompson said her cuts would save the city about $8 million. She said her proposals will close the nearly $4 million gap in the budget, allow the city to make payroll next month and help ease the financial pain of the incinerator debt.

But not everyone is happy with the mayor's recommendations.

"I'm disturbed by it," said one taxpayer. "To me, a property tax increase as well as a water rate increase would be something I find objectionable." [TILB - while we totally agree, Johnny Taxpayer needs to recognize that these are symptoms of the debt and spending problem. It's like getting herpes from unprotected but enjoyable sex and then saying you find the sores "objectionable".]

Thompson said she is also considering selling or leasing the city's assets, including parking garages and City Island. [TILB - Honestly, this is a great idea...I mean, other than the fact that this is a horrible time to sell these sorts of assets. Maybe some public REIT with overpriced equity financing will provide the necessary bid. Why should municipalities be in the business of managing parking garages anyway?]

City council will look into the mayor's budget proposal at Thursday's budget and finance committee meeting.

Friday, January 29, 2010

The Final Countdown: Greek Sovereign Default

The aptly named band Europe brought us the epic music video and song "The Final Countdown" about 20 years too early (I mean, who cares about the countdown to the end of communism - let's talk about the PIIGS sovereign default).

As I read all these articles about Greece's impending doom, it's hard not to hear in the back of my head the implied complaint, "why won't they just lend us the money for free? This doesn't make any sense. Just lend us the money for free!"

[emphasis added and comments in brackets]

As we've been saying for a year, just wait until Japan blows. It's situation is nearly twice as bad as Greece's. Despite having 40% of the U.S.'s GDP, it has as much debt. If its blended cost of funding goes up from 1.5% to a bit over 3%, 100% of its tax revenue will be absorbed by interest expense. We're talking about the second largest economy in the world and it literally has no other options than massively debasing its currency or defualting on its debt (or, more likely, both). That's what they get for following Bernanke's wicked advice.

The sooner Japan blows, the better for the U.S. - I suspect our only hope of not suffering the same fate is to witness Japan's meltdown after having followed a similar prescription.

And as to Europe, just wait until Greece's implosion lights up Italy, which is a very large economy. That is the real worry the EU is facing: do we let Italy go?

Which brings us full circle, to The Final Countdown...

As I read all these articles about Greece's impending doom, it's hard not to hear in the back of my head the implied complaint, "why won't they just lend us the money for free? This doesn't make any sense. Just lend us the money for free!"

[emphasis added and comments in brackets]

Europe Weighs Possibility of Debt Default in GreecePeople think this is news?

New York Times

By STEPHEN CASTLE and MATTHEW SALTMARSH

European leaders are quietly considering whether to come to the aid of their troubled neighbor Greece amid fears that the nation might default on its debts and unleash another round of financial crisis.

Only a month after Dubai was rescued by its neighboring emirate Abu Dhabi, Germany, France and other European powers are discussing whether Greece might need a bailout too.

After a decade of debt-fueled profligacy, Greece is confronting what amounts to a run on the bank. And, despite repeated assurances from Athens, the nation’s strained finances have put already jittery financial markets on edge. On Thursday, the worries stretched all the way to Wall Street, where the stock market sank 1.1 percent.

Some economists worry that Greece’s troubles could have deep and lasting repercussions for Europe. The crisis poses complex challenges for the euro, which Greece adopted in 2001. The currency sank to a six-month low against the dollar and yen on Thursday.[ironically, TILB thinks letting Greece go could be an incredibly strong event for the euro]

“Greece failing is not an option, and lots of people think that we will have to intervene at some stage,” said one European finance official, who was not permitted to speak publicly on the matter. “It doesn’t have to happen, and we hope it won’t, but it would be better than seeing a default.”

...

But doubts have intensified over the credibility of the drastic austerity measures put forward to try to get Greece’s budget under control, in spite of concerted efforts by the Greek government to calm the markets.

Investors worry that the crisis in Greece could touch off a domino effect across Southern Europe. Many are fleeing bond markets in Portugal, Spain and Italy out of concern the troubles might spread. [TILB - Collectively known as the PIIGS when Ireland is included]

The market’s judgment has been swift and brutal. On Thursday, the difference between the interest rates on Greek and German bonds — a measure of the risk investors perceive in the Greek debt — rose to nearly four full percentage points, its highest level since the euro was adopted.

Officials in Athens, Frankfurt and Brussels remained adamant that Greece was not at risk of being forced to abandon the euro. [TILB - of course not. Could you imagine if they said, "hey, we're thinking of going back to the Drachma so that we can print our way out of this debacle?" That would be amazing.]

As a condition of any aid package, the Greek government led by Mr. Papandreou would be asked to provide a more detailed program to bring the country’s deficit — currently equal to 12.7 percent of gross domestic product — under control. European Union rules call for a maximum of 3 percent. Officials insist that any bailout must not put into doubt the credibility of the euro.

Another condition of any aid would be further guarantees over the reliability of Greece’s economic data. Last year the newly elected government in Athens announced a sharp upward revision of its deficit figures, which have since been exposed as seriously flawed.

Next week, the European Commission is expected to propose greater powers for the European statistical agency, Eurostat, to audit the accounts of national governments. [TILB - watch Czech president Vaclav Klaus give this interview where he presciently assesses the fact that the EU and the Euro are forfeitures of sovereignity and freedom, then watch the slow leech of powers from the states to the centralized United States of Europe]

The latest moves reflect a continuing skepticism among euro-zone members over the practicality of the plans put forward so far by the Greek government. Athens wants to reduce the deficit to 3 percent of G.D.P. by 2012, an objective described as unrealistic by one European diplomat, also speaking on condition of anonymity. These plans are also to be assessed by the commission next week.

Greece’s budget deficit is four times the E.U. limit, while the country’s debt amounts to 113 percent of G.D.P. But officials insist that, because Greece is not one of the euro zone’s larger economies, the problems created by its grim public finances can be absorbed. The Greek economy represents about 2.5 percent of the euro area’s G.D.P. [TILB - Japan is over 200% sovereign debt to GDP and the US is a bit over 80%. Carmen Reinhardt and Kenneth Rogoff show that 90% is the threshold past which few survive, as well as 60% externally financed debt to GDP - this latter point has been Japan's saving grace, though that is likely over]

...

For Greece’s neighbors, there is the possibility of a domino effect, with investors subsequently moving on to test the resilience of another heavily indebted member of the euro area — possibly Italy, whose debt is also 113 percent of its gross domestic product.

...

One option, deemed unlikely, would be issuing a sovereign bond for the entire 16-nation euro area. That would probably require complex legal changes among members. [TILB - see prior Vaclav Klaus reference]

...

On Monday, Greece paid a hefty 6.22 percent rate to borrow money in the bond market, underscoring investors’ concern. [TILB - and it's much more expensive for them already, just five days later. If memory serves us well, they have a number of huge maturities in April/May that will be challenging to finance affordably without German backstop...]

In an interview this week, the Greek finance minister, George Papaconstantinou, acknowledged that the high rates were punitive but asked that investors keep faith. Greece needs to raise at least 53 billion euros this year, much of it this spring.

As we've been saying for a year, just wait until Japan blows. It's situation is nearly twice as bad as Greece's. Despite having 40% of the U.S.'s GDP, it has as much debt. If its blended cost of funding goes up from 1.5% to a bit over 3%, 100% of its tax revenue will be absorbed by interest expense. We're talking about the second largest economy in the world and it literally has no other options than massively debasing its currency or defualting on its debt (or, more likely, both). That's what they get for following Bernanke's wicked advice.

The sooner Japan blows, the better for the U.S. - I suspect our only hope of not suffering the same fate is to witness Japan's meltdown after having followed a similar prescription.

And as to Europe, just wait until Greece's implosion lights up Italy, which is a very large economy. That is the real worry the EU is facing: do we let Italy go?

Which brings us full circle, to The Final Countdown...

Labels:

Bernanke,

Budget Deficit,

Czech Republic,

Default Rate,

Drachma,

EU,

Euro,

Europe,

Final Countdown,

Greece,

Ireland,

Japan,

PIIGS,

Portgual,

Reinhardt,

Schwarzies,

Spain,

Trichet,

Vaclav Klaus

Wednesday, January 27, 2010

State Of The Union - Summary: "It's A Shitshow Out There"

Watching Obama's debacle of a State of the Union address reminds us of Thomas Sowell's prescient analysis from almost a year and a half ago.

Sowell link.

As an aside, did anyone else find Obama referencing the Constitution at the beginning of his speech ironic?

Sowell link.

As an aside, did anyone else find Obama referencing the Constitution at the beginning of his speech ironic?

Tuesday, January 19, 2010

U.S. Rail Data Crushingly Negative

[HT: Max Headroom and LB]

The weekly railroad traffic data collected by the Association of American Railroads (AAR) did not have a particularly difficult comp in January. You may recall that in January 2009, it seemed as if the world had stopped as retailers and suppliers were crushed by excess inventory that needed to be burned off. Those same businesses allegedly just stopped placing orders leading to the collapse in rail volumes during November and December of 2008 in the below graph. January 2009 was no better.

2010 - Jan 14 - AAR Data

So January 2010, even if still in the teeth of a recession, should at least have the benefit of not dealing with an excess inventory problem. It should have been better than January 2009.

But alas. In fact, the first week of January is comping well below the worst average month in all of 2008 or 2009 (or any month for YEARS, for that matter). Green shoots?

From the AAR's weekly rail data release (emphasis added):

The weekly railroad traffic data collected by the Association of American Railroads (AAR) did not have a particularly difficult comp in January. You may recall that in January 2009, it seemed as if the world had stopped as retailers and suppliers were crushed by excess inventory that needed to be burned off. Those same businesses allegedly just stopped placing orders leading to the collapse in rail volumes during November and December of 2008 in the below graph. January 2009 was no better.

2010 - Jan 14 - AAR Data

So January 2010, even if still in the teeth of a recession, should at least have the benefit of not dealing with an excess inventory problem. It should have been better than January 2009.

But alas. In fact, the first week of January is comping well below the worst average month in all of 2008 or 2009 (or any month for YEARS, for that matter). Green shoots?

From the AAR's weekly rail data release (emphasis added):

WASHINGTON, D.C. – Jan. 14, 2010 – The Association of American Railroads today reported that freight rail traffic is off to a slow start in 2010 with U.S. railroads originating 236,796 carloads for the week ending Jan. 9, 2010, down 12.4 percent compared with the same week in 2009 and down 28 percent from the same week in 2008. In order to offer a complete picture of the progress in rail traffic, AAR will now be reporting 2010 weekly rail traffic with year-over-year comparisons for both 2009 and 2008.Helicopter Ben, your authotization to continue debasing has arrived. Continue your destructive ways freely.

Thursday, January 14, 2010

California Debt Is Downgraded: Schwarzies Prepare For A Comeback!

TILB is so incredibly thankful that - as we informed our readers over and over again last spring and summer (click here for all TILB posts referencing Schwarzies) - California has not at all fixed its budget woes. It has another $20 billion deficit expected in the coming 18 months.

It seems as if California lawmakers think this problem might solve itself. That somehow, they are going to miraculously bring in another $14 billion in tax "revenue" - annually mind you - over any reasonably near term period.

Spoiler Alert: Ain't gonna happen. In fact, the more you raise taxes when you are already a high tax regime like California, in the long run, the less tax "revenue" the state can expect to receive. It will actually worsen its problem by driving out marginal growth and productive investment.

The obvious solution is not to try to raise another $14 billion per year - it's to cut $14 billion more in spending per year. Free that capital up so that your citizenry can productively deploy it rather than having a bunch of proven morons in Sacramento deploy it destructively.

As we promised back in July 2009, TILB stands ready to laugh in California's face as their legislature acts like a political set of keystone cops.

Below and linked here is a Reuters article discussing the S&P downgrade [emphasis added and comments in brackets are TILB's].

It seems as if California lawmakers think this problem might solve itself. That somehow, they are going to miraculously bring in another $14 billion in tax "revenue" - annually mind you - over any reasonably near term period.

Spoiler Alert: Ain't gonna happen. In fact, the more you raise taxes when you are already a high tax regime like California, in the long run, the less tax "revenue" the state can expect to receive. It will actually worsen its problem by driving out marginal growth and productive investment.

The obvious solution is not to try to raise another $14 billion per year - it's to cut $14 billion more in spending per year. Free that capital up so that your citizenry can productively deploy it rather than having a bunch of proven morons in Sacramento deploy it destructively.

As we promised back in July 2009, TILB stands ready to laugh in California's face as their legislature acts like a political set of keystone cops.

Below and linked here is a Reuters article discussing the S&P downgrade [emphasis added and comments in brackets are TILB's].

UPDATE 4-California debt rating cut as cash crunch looms

8:03pm EST* S&P sees budget solution possibly crimping economy

* $19 bln shortfall tougher to close than last year's-S&P [no shit - you can't cut the fat you already cut, so it's all new fat here]

* Cash crunches seen in March, July, but RANs to be paid (Recasts, adds debt insurance costs and comparison)

By Jim Christie and Peter Henderson

SAN FRANCISCO, Jan 13 (Reuters) - California's main debt rating was cut on Wednesday by Standard & Poor's, which said the government of the most populous U.S. state could nearly run out of cash in March -- and another rating cut might follow.

The state government's budget gap of nearly $20 billion over the next year and a half leaves it in a precarious situation, requiring tax increases or spending cuts, either of which may slow economic recovery, the agency said in a statement.

"If economic or revenue trends substantially falter, we could lower the state rating during the next six to 12 months," S&P said after cutting the rating on $63.9 billion of California's general obligation debt one notch to A- from A.

The new level is four notches above "junk" status, a level at which many investors refuse to buy debt.

"The big question is, is there any fear they will get downgraded out of investment grade (so) you may have to sell ... that's where I think it would get interesting or hairy," said Eaton Vance portfolio manager Evan Rourke.

Bond prices did not move much, though, since many expected the downgrade, he said.

S&P's downgrade was overdue because the state's revenues have been so weak, said Dick Larkin, director of credit analysis at Herbert J. Sims Co Inc in Iselin, New Jersey. "Frankly I can't understood why it took S&P so long," he said. "They could have made that decision back in September." [September? Try March.]

$1 BILLION SHORT IN MARCH

California already had the lowest debt rating of any U.S. state before the downgrade, and 39 state governments are struggling with shortfalls this fiscal year, according to the nonpartisan Center on Budget and Policy Priorities.

Many are begging for more federal funds and caught between cutting social programs, raising taxes, or both.

The housing market implosion was felt especially strongly in California, a subprime mortgage lending center. Its double-digit unemployment rate, one of the highest in the United States, is expected to endure for a year or more.

California's government resorted to issuing IOUs last year for the second time since the Great Depression when it nearly ran out of cash. Officials are scrambling to raise $1 billion for March and the shortfall could be worse in July, S&P said. [sounds like Schwarzies are coming back; we're almost giddy with excitement!]

State Treasurer Bill Lockyer's spokesman Tom Dresslar said S&P's downgrade "highlights the critical need for the legislature and the governor to produce a swift budget resolution that is credible to the market."

"Standard & Poor's makes it clear the failure to act in a timely manner and with credibility threatens to further lower our GO rating," Dresslar said, adding that a further cut would hit taxpayers already paying higher interest rates than people in some emerging economies.

The cost to insure California's debt with credit default swaps is now higher than debt of developing countries, such as Kazakhstan, Lebanon and Uruguay. It costs $277,000 per year for five years to insure $10 million in California debt, compared with $172,000 for Kazakh debt. [phenomenal]

George Strickland, a municipal bond mutual fund manager at Thornburg Investment Management said S&P still has California GOs rated too high. Moody's Investors Service has a Baa1 rating on the debt and Fitch Ratings rates the bonds BBB.

"There's another notch to go before they hit bottom," Strickland said, adding that he expects another long and ugly battle to fill the state budget's shortfall.

Governor Arnold Schwarzenegger less than a week ago unveiled a plan to balance the state's books, largely with spending cuts that he described as draconian and which leaders of the Democrat-controlled legislature sharply criticized. [I can't wait to see the Donkey-proposed alternative - Lord willing it involves more unconstitutional minting of Schwarzies by Sacramento]

S&P said "timely progress" on a budget fix would be impeded by previous reliance on one-time measures, fewer choices for one-time cuts, extraordinary reliance on federal aid in Schwarzenegger's plan, and California's unusual requirement for a supermajority of lawmakers to pass a budget.

The Republican governor's budget plan also said that while the state government faces cash challenges in March, it will have sufficient cash to repay $8.8 billion in revenue anticipation debt in May and June as scheduled. [whether true or not, what else can they say? Any other statement would be a hand delivered invitation for the ratings agencies to slash the G.O. rating further]

State Finance Director Ana Matosantos along with Lockyer and State Controller John Chiang said on Monday they are working together so the state government honors its RAN debt.

Bond payments are by law a top state priority and state Finance Department spokesman H.D. Palmer said they will be honored: "Even though we've got to make some decisions in managing March we absolutely have ample cash on hand to make our RAN payments in May and June on time and in full."

Larkin said the three major rating agencies will hold off on more downgrades to California's credit rating to avoid roiling the municipal debt market, even in the event budget talks between Schwarzenegger and lawmakers drag on.

"They'll give the state an awful lot of rope," Larkin said. "For a state to go below investment grade would cast a pall on every state and local issuer out there." [at least market participants publicly acknowledge that the ratings agencies are pussies]

(Reporting by Jim Christie, Peter Henderson, Karen Brettell and Joan Gralla; Editing by Andrew Hay, Gary Hill)

Labels:

Arnold Schwarzenegger,

Budget Deficit,

California,

IOUs,

Schwartzies,

Schwarzies

Wednesday, January 13, 2010

Hayman Capital's Kyle Bass Gives Interview On CNBC

Kyle Bass of Hayman Capital (enjoy a past letter of his here) will be testifying in front of the Congressional Financial Crisis Inquiry Commission (FCIC) today as a market participant playing counterpunch to a bunch of big name bankers that are there to defend the role of banks in the crisis. Hopefully Lloyd talks more about how Goldman is doing "God's work."

Bass talks to David Faber in this video about capital adequacy of banks, Freddie and Fannie, and the looming meltdown of Japan (further proof of The Singularity risk).

Enjoy.

Bass talks to David Faber in this video about capital adequacy of banks, Freddie and Fannie, and the looming meltdown of Japan (further proof of The Singularity risk).

Enjoy.

Monday, January 11, 2010

Jeffrey Gundlach, CEO Of DoubleLine Capital, Responds To Lawsuit From TCW

Gundlach strikes back at TCW and defends his honor.

Dear Friends of DoubleLine:

I am writing to address briefly the business dispute between Trust Company of the West and my new firm, DoubleLine Capital LP. As has been widely reported in the press, TCW filed suit last week against DoubleLine, me and some of my trusted colleagues. I have referred TCW's unfortunate litigation tactics to my legal team and expect this matter to be handled as a business dispute in the ordinary course. My portfolio management and trading teams and I continue to focus on the work of building DoubleLine and managing our clients' accounts. We are dedicated to the well being of our clients and to delivering on our promise to treat our clients' precious capital as our own.

DoubleLine has made remarkable progress in the past few weeks. We have in place our seasoned Mortgage, Corporate, Emerging Markets and Core Fixed Income teams; the Securities and Exchange Commission has approved our application to become a registered Investment Adviser; we have occupied our new permanent office and trading space in downtown Los Angeles; and we have established separate accounts on behalf of our initial clients. We look forward to sharing further news of our progress in the days and weeks ahead.

While I am resolved not to let TCW distract me or my team, TCW has disseminated certain smears and innuendoes that I am unwilling to let pass without at least a brief comment.

First of all, I was a loyal and extraordinarily productive employee of TCW for over 24 years. I have very good feelings toward many of the people with whom I worked there. And I am proud of the significant contributions by my teams and myself to the historic success of TCW.

In January 2009, TCW's parent, Société Générale, publicly announced that it was no longer interested in being in the money management business in a meaningful way. Soc Gen has since wound down direct involvement in its primary money management arm and discussed plans for an IPO or other paths of divestiture of TCW sometime before 2014. I became deeply concerned about the extended period of uncertainty: how would the divestment of TCW occur? How would that uncertainty affect me, my colleagues, the business and our clients? I know that other senior managers at TCW shared the same concerns at the time and do so to this day.

In response, in my last few months at TCW, I explored avenues to purchase the business, overtures that were rebuffed. Although I had begun to consider other options, I fully expected up until my dismissal on December 4 that, if I left TCW, I would do so in a negotiated transaction that was accommodative to clients as well as mutually beneficial for TCW and myself. It is unfortunate that TCW elected to take another route.

A second deeply disturbing element of TCW's actions has been its invasion and searching of locked drawers in my office at TCW's headquarters in downtown Los Angeles and of a small personal office I kept in Santa Monica. I personally paid the rent and all other expenses for the operation of this office. After seizing these offices, TCW refused to allow me to collect my personal possessions, and the salacious disclosure in TCW's lawsuit of certain of the items apparently taken there from is a transparent attempt to embarrass me and harm my business. While these actions will no doubt be subjects of litigation, suffice it to say that I had every expectation of privacy in these spaces, which stored vestiges of closed chapters of my life.

Notwithstanding TCW's scorched earth legal policy, I am certain that no employee of TCW, past or present, friend or foe, can honestly say that they ever had any experience with me, either in the office, on the road or in any meeting, in which there was any improper activity consistent with the innuendoes, smears and gross distortions to which TCW has shamelessly subjected me in its lawsuit.

I assure you that I remain the worthy fiduciary in whom you have entrusted your investments over many years. Together with my team, I navigated the treacherous credit crisis markets and protected and grew your principal while others failed. I believe that we at DoubleLine have earned your trust, and hope that you will continue to permit us to protect and make money for you and with you.

Sincerely,

Jeffrey Gundlach

Chief Executive Officer

DoubleLine Capital LP

Contact Information

phone: 213-633-8200

Wednesday, January 06, 2010

Thank Goodness For Food Stamps - These Job Seekers Would Do Anything For A Job If One Simply Existed

This past Sunday, The New York Times ran a front page article on the massive increase in people living off food stamps alone (no other income whatsoever).

Peppered with sad tales like that of Isabel Bermudex who went from a poor upbringing to earning $180,000 in one year as a real estate agent during the boom before falling back to nothing, the article is intended to tug at the heart strings. It emphasizes the desperate straights of these unemployed and incomeless folks and how badly they want an honest day's work.

Throughout the article, people talk about wanting - but not being able to find - jobs and the terrible situation they'd be in without government handouts.

We certainly don't doubt it.

What we do doubt is that the solution is more handouts; more government. Government interference is the problem - it is what prevents most people from finding gainful employment. We have a huge excess supply of labor that allegedly wants nothing more than employment (10% unemployed). Any income is better than no income, all else being equal. However, our strict minimum wage legislation prevents the natural market clearing mechanism from taking place. As any freshman econ major can tell you, virtually any amount of supply of goods or services that has positive value can be cleared at the right price. Further, because we pay people not to work when they lose their jobs, the hurdle for accepting new work is artificially raised by the government subsidy the individuals receive.

The minimum wage and welfare-type programs are painful legacies of the New Deal era that oontinue to wreak havoc today. The people in the article below continue to suffer from F.D. Roosevelt's mad science. TILB used to think the minimum wage level didn't particularly matter because during the long period of full employment it really didn't. However, during periods of economic downturn, minimum wage basically puts a chokehold on remployment - not allowing labor prices to reset and preventing companies from hiring.

In reality, the minimum wage and other cost raising government interferences like it are nothing but Chinese economic stimulus legislation.

As our policies make it impossibly uneconomic for Americans to be employed in America by American companies, the government is basically encouraging those same companies to send wages and much needed investment capital overseas to countries that have more friendly policies toward their populous - policies that don't legally prevent citizens from working for a wage they'd happily accept and worse, that pay people not to work!

Only a government official or tunnel visioned theoretical academician could come up with this foolishness. Sadly, we seem to have returned to this sort of thinking at our highest levels. It virtually guarantees that our country will struggle to reach a full recovery.

Sometimes we wonder if that underperformance and increase of government supplicants isn't actually the goal of the left; to enslave the underemployed and undereducated to resources provided by their friendly congressman.

Intentional or not, that is the outcome of these thoughtless laws.

Article excerpts below.

Peppered with sad tales like that of Isabel Bermudex who went from a poor upbringing to earning $180,000 in one year as a real estate agent during the boom before falling back to nothing, the article is intended to tug at the heart strings. It emphasizes the desperate straights of these unemployed and incomeless folks and how badly they want an honest day's work.

Throughout the article, people talk about wanting - but not being able to find - jobs and the terrible situation they'd be in without government handouts.

We certainly don't doubt it.

What we do doubt is that the solution is more handouts; more government. Government interference is the problem - it is what prevents most people from finding gainful employment. We have a huge excess supply of labor that allegedly wants nothing more than employment (10% unemployed). Any income is better than no income, all else being equal. However, our strict minimum wage legislation prevents the natural market clearing mechanism from taking place. As any freshman econ major can tell you, virtually any amount of supply of goods or services that has positive value can be cleared at the right price. Further, because we pay people not to work when they lose their jobs, the hurdle for accepting new work is artificially raised by the government subsidy the individuals receive.

The minimum wage and welfare-type programs are painful legacies of the New Deal era that oontinue to wreak havoc today. The people in the article below continue to suffer from F.D. Roosevelt's mad science. TILB used to think the minimum wage level didn't particularly matter because during the long period of full employment it really didn't. However, during periods of economic downturn, minimum wage basically puts a chokehold on remployment - not allowing labor prices to reset and preventing companies from hiring.

In reality, the minimum wage and other cost raising government interferences like it are nothing but Chinese economic stimulus legislation.

As our policies make it impossibly uneconomic for Americans to be employed in America by American companies, the government is basically encouraging those same companies to send wages and much needed investment capital overseas to countries that have more friendly policies toward their populous - policies that don't legally prevent citizens from working for a wage they'd happily accept and worse, that pay people not to work!

Only a government official or tunnel visioned theoretical academician could come up with this foolishness. Sadly, we seem to have returned to this sort of thinking at our highest levels. It virtually guarantees that our country will struggle to reach a full recovery.

Sometimes we wonder if that underperformance and increase of government supplicants isn't actually the goal of the left; to enslave the underemployed and undereducated to resources provided by their friendly congressman.

Intentional or not, that is the outcome of these thoughtless laws.

Article excerpts below.

January 3, 2010

The Safety Net

Living on Nothing but Food Stamps

By JASON DEPARLE and ROBERT M. GEBELOFF

CAPE CORAL, Fla. — After an improbable rise from the Bronx projects to a job selling Gulf Coast homes, Isabel Bermudez lost it all to an epic housing bust — the six-figure income, the house with the pool and the investment property.

Now, as she papers the county with résumés and girds herself for rejection, she is supporting two daughters on an income that inspires a double take: zero dollars in monthly cash and a few hundred dollars in food stamps.

With food-stamp use at a record high and surging by the day, Ms. Bermudez belongs to an overlooked subgroup that is growing especially fast: recipients with no cash income.

About six million Americans receiving food stamps report they have no other income, according to an analysis of state data collected by The New York Times. In declarations that states verify and the federal government audits, they described themselves as unemployed and receiving no cash aid — no welfare, no unemployment insurance, and no pensions, child support or disability pay.

Their numbers were rising before the recession as tougher welfare laws made it harder for poor people to get cash aid, but they have soared by about 50 percent over the past two years. About one in 50 Americans now lives in a household with a reported income that consists of nothing but a food-stamp card.

“It’s the one thing I can count on every month — I know the children are going to have food,” Ms. Bermudez, 42, said with the forced good cheer she mastered selling rows of new stucco homes.

Members of this straitened group range from displaced strivers like Ms. Bermudez to weathered men who sleep in shelters and barter cigarettes. Some draw on savings or sporadic under-the-table jobs. Some move in with relatives. Some get noncash help, like subsidized apartments. While some go without cash incomes only briefly before securing jobs or aid, others rely on food stamps alone for many months.

...

A skinny fellow in saggy clothes who spent his childhood in foster care, Rex Britton, 22, hopped a bus from Syracuse two years ago for a job painting parking lots. Now, with unemployment at nearly 14 percent and paving work scarce, he receives $200 a month in food stamps and stays with a girlfriend who survives on a rent subsidy and a government check to help her care for her disabled toddler.

“Without food stamps we’d probably be starving,” Mr. Britton said.

A strapping man who once made a living throwing fastballs, William Trapani, 53, left his dreams on the minor league mound and his front teeth in prison, where he spent nine years for selling cocaine. Now he sleeps at a rescue mission, repairs bicycles for small change, and counts $200 in food stamps as his only secure support.

“I’ve been out looking for work every day — there’s absolutely nothing,” he said.

A grandmother whose voice mail message urges callers to “have a blessed good day,” Wanda Debnam, 53, once drove 18-wheelers and dreamed of selling real estate. But she lost her job at Starbucks this year and moved in with her son in nearby Lehigh Acres. Now she sleeps with her 8-year-old granddaughter under a poster of the Jonas Brothers and uses her food stamps to avoid her daughter-in-law’s cooking.

“I’m climbing the walls,” Ms. Debnam said.

...

But others say the lack of cash support shows the safety net is torn. The main cash welfare program, Temporary Assistance for Needy Families, has scarcely expanded during the recession; the rolls are still down about 75 percent from their 1990s peak. A different program, unemployment insurance, has rapidly grown, but still omits nearly half the unemployed. Food stamps, easier to get, have become the safety net of last resort.

“The food-stamp program is being asked to do too much,” said James Weill, president of the Food Research and Action Center, a Washington advocacy group. “People need income support.”

...

The expansion of the food-stamp program, which will spend more than $60 billion this year, has so far enjoyed bipartisan support. But it does have conservative critics who worry about the costs and the rise in dependency.

“This is craziness,” said Representative John Linder, a Georgia Republican who is the ranking minority member of a House panel on welfare policy. “We’re at risk of creating an entire class of people, a subset of people, just comfortable getting by living off the government.”

Mr. Linder added: “You don’t improve the economy by paying people to sit around and not work. You improve the economy by lowering taxes” so small businesses will create more jobs.

...

Kevin Zirulo and Diane Marshall, brother and sister, have more unlikely stories than a reality television show. With a third sibling paying their rent, they are living on a food-stamp benefit of $300 a month. A gun collector covered in patriotic tattoos, Mr. Zirulo, 31, has sold off two semiautomatic rifles and a revolver. Ms. Marshall, who has a 7-year-old daughter, scavenges discarded furniture to sell on the Internet.

They said they dropped out of community college and diverted student aid to household expenses. They received $150 from the Nielsen Company, which monitors their television. They grew so desperate this month, they put the breeding services of the family Chihuahua up for bid on Craigslist.

“We look at each other all the time and say we don’t know how we get through,” Ms. Marshall said.

...

Ms. Bermudez recently answered the door in her best business clothes and handed a reporter her résumé, which she distributes by the ream. It notes she was once a “million-dollar producer” and “deals well with the unexpected.”

“I went from making $180,000 to relying on food stamps,” she said. “Without that government program, I wouldn’t be able to feed my children.”

Labels:

Food Stamps,

Minimum Wage,

N.Y. Times,

Newspapers,

Unemployment,

Welfare

Friday, January 01, 2010

Liberty Quote Of The Day: George Bernard Shaw

We instantly fell in love with this quote, when we heard it released from the lips of Margaret Thatcher, although it originates from George Bernard Shaw. It is so true. Enjoy the bonus Thatcher video below.

"Freedom incurs responsibility; that is why so many men fear it."- George Bernard Shaw

Wednesday, December 30, 2009

Tilson's Response To Hovde's Response To Pershing Square's Response To Hovde's Response To Pershing Square's Views On Mall REITS And GGP Specifically

Whitney Tilson (T2 Partners) re-inserts himself into the Pershing Square vs. Hovde debate on GGP. To be fair, Hovde did take a shot at Tilson's GGP analysis on page 63of its Dec. 29th presentation. For those wondering, T2's analysis is largely a derivation of Pershing Sqaure's, which is not surprising given the two firms' histories of sharing research and investment ideas (and Tilson and Ackman's long friendship).

Tilson emailed the following to his regular distribution list:

Tilson emailed the following to his regular distribution list:

Hovde Capital yesterday released its response (link here) to Pershing Square’s rebuttal (link here) (and, to a minor extent, and our rebuttal (link here)) of Hovde’s initial report on GGP (link here).TILB is on record as saying we love to see the debate. It's healthy for markets and educational.

Our quick take is that it’s more of the same – like Hovde’s first report, there are a few good points (nothing we hadn’t already considered) mixed in with many arguments that are either factually incorrect or misleading, or with which we simply disagree. In short, there’s nothing new that changes our view regarding the attractiveness of GGP (it remains by far our largest position).

Before proceeding, we want to make clear how much we enjoy the debate and think our markets would be much healthier if there were a similarly detailed exchange of viewpoints for EVERY stock!

To some extent, the debate is now about different views of the future: Hovde believes that consumer spending will be terrible for an extended period and that bankruptcies among mall-based retailers will continue or worsen, which will translate into severely declining NOI for GGP over time. Pershing believes that the worst is behind us: that unemployment has peaked, consumer spending has stabilized and may even be picking up a bit, and that retailers are in remarkably good shape in light of what they’ve been through over the past 18 months, all of which will translate into approximately stable NOI. Whether Hovde or Pershing is right about GGP over time will, to some extent, depend on future macro factors, which are obviously impossible to predict with certainty.

That said, good analysis matters and we think Hovde’s is sorely lacking, primarily in the following areas:

1) Hovde’s most serious mistake is misunderstanding (or misrepresenting) what will likely happen to GGP’s unsecured debt. Hovde assumes that it either remains outstanding (throughout its presentation, Hovde calculates GGP’s leverage and interest payments assuming that the debt remains outstanding, which is the main reason its analysis differs from Pershing’s and ours – see page 63, for example) or that it converts to equity, which will result in “significant dilution” (page 72). Hovde makes explicit this assumption when it claims that Pershing “does not use consistent assumptions” regarding what happens to the unsecured debt on page 35 of its report.

Hovde doesn’t appear to understand bankruptcy law and what will likely happen to the unsecured debt. There is almost no chance that it will remain outstanding: it will either be refinanced or, more likely, be converted into equity (this is what Pershing assumes – there is no inconsistency). But here’s the key: it will NOT BE DILUTIVE because it will convert AT FAIR VALUE, as determined by the bankruptcy judge. Of course, if the judge determines that fair value is $1/share, then it would be massively dilutive, but that’s not going to happen. The judge has a great deal of discretion in determining fair value, but will certainly take into consideration the current stock price, comps and the price of any equity offering(s) GGP might do.

For example, as soon as GGP exits bankruptcy and its stock is relisted (it currently trades on the pink sheets, which means most institutional investors can’t own it), it will be a must-own stock for every REIT fund (a big catalyst Hovde misses). To meet this demand and pay down some debt, GGP might issue equity – and the negotiated price at which this stock is sold would likely weigh heavily on the judge’s determination of fair value (and would not be dilutive). Of course, if someone like Simon were to buy GGP at, say, $20, the debt would convert at this price – and again, it wouldn’t be dilutive.

2) Hovde takes seven pages (6-12) arguing for its definition of NOI, but there’s no right answer here. NOI is like free cash flow: different people calculate it in different ways. But however one calculates it, it’s important to be consistent – which Hovde is not. It uses the most conservative assumptions to minimize GGP’s NOI, but then fails to do so for Simon, making its comp analysis deeply flawed.

3) Speaking of comps, Hovde writes: “to suggest GGP should trade at the LOWER cap rate than SPG is LAUGHABLE in our view” (pages 22-23). Hovde can laugh all it wants, but there are very good arguments for why Simon is, in fact, the best comp for GGP. For starter, both have very similar mall portfolios with a national footprint (unlike Macerich, which Hovde cites as a better comp on page 63; MAC also has debt issues that are more significant than what GGP will likely have post-bankruptcy). In addition, GGP will likely have a BETTER liability profile post-bankruptcy, with no maturities until January 2014. Finally and most importantly, GGP is for sale and Simon isn’t, so there should be a premium for GGP reflecting a possible sale of this strategic asset.

4) Hovde’s analysis treats GGP as a collection of assets, but it’s more than that. The fact that GGP is in bankruptcy has put it into play, so there is a once-in- a-lifetime opportunity for Simon, Brookfield or someone else to acquire a national platform, as highlighted in this quote from the WSJ:

The opportunity “is a potentially transformational event that doesn’t come along very often,” says Steve Sakwa, an analyst with International Strategy and Investment Group Inc.

5) Hovde dismisses the likelihood that GGP might be acquired (pages 51-55), focusing only on Simon and not even mentioning Brookfield, which may in fact be the more likely acquirer due to fewer anti-trust concerns and the need for a national platform (which Simon already has). As noted above, Hovde misses the value of GGP as a strategic asset – no doubt, there’s lots of distressed inventory out there, but only one national platform for sale like GGP.

Finally, Hovde finds it “telling” that Simon and Brookfield bought GGP’s unsecured debt, but not the equity, even when the equity was at a much lower price. But it’s not as telling as Hovde thinks for a number of reasons. First, it’s possible that Simon and/or Brookfield do in fact own the equity – if either bought less than 5% of GGP, it wouldn’t have to file (in any case, for anti-trust reasons, they couldn’t acquire more than 7.5%). Also, at the time they bought GGP’s debt it was very cheap and they might have reasonably concluded that it represented a better risk-reward than the equity.

6) Hovde argues that GGP’s rental rates and leasing spreads are very poor and will likely get worse (pages 15-18). They have indeed been under pressure, but Hovde is making the classic investing mistake of projecting the immediate past indefinitely into the future. What Hovde is missing is that GGP over the past year, knowing that it was in a poor negotiating position due to the macro environment and its own bankruptcy, has been renewing leases mainly on a short-term basis. These renewals have indeed been done at low rates, but this isn’t likely to be a permanent state of affairs. The macro environment has at least stabilized and may be improving and GGP will soon either be acquired or exit bankruptcy, so its negotiating position will strengthen and therefore rental rates and leasing spreads will likely improve.

7) On pages 28 and 33, Hovde repeats the charts from its first presentation (pages 33-34), showing that “Commercial Real Estate Prices Have Dropped 43% Since the Peak” and that cap rates are moving higher under the heading: “Despite Speculation to the Contrary, Cap Rates for All Property Types Are Moving Higher, Not Lower. Does Pershing Square Believe These Transactions Did Not Happen?” But the CRE chart doesn’t include mall real estate and the cap rate chart, while showing cap rates for virtually every other type of commercial real estate, is MISSING data for malls! (The cap rate for mall REITs has fallen dramatically from earlier this year.)

8) Hovde paints a very bearish picture of retail sales (page 61), but the latest data contradicts this – for example, an article in the NYT earlier this week www.nytimes.com/2009/12/28/business/28shop.html) noted:

Over all, retail sales from November through Dec. 24 rose 3.6 percent from last year, according to SpendingPulse, an information service of MasterCard Advisors that estimates sales for all forms of payment, including cash, checks and credit cards.

That number — which does not include sales of automobiles and gasoline — was helped this year by an extra shopping day between Thanksgiving and Christmas. Adjusting the results for that extra day cuts the retailing industry’s sales increase to about 1 percent, in line with what many retailing professionals expected.

While the numbers do not suggest a turnaround for the industry, they signal an improvement over last year’s 2.3 percent sales decline…

… “Last year was just a storm and retail was all about dropping prices to get rid of inventory,” said Mr. Katz of AlixPartners. “This year it was much more of a planned strategy: low inventories and tight expenses. And controlled promotions.”

That means most stores did not erode their profit margins the way they did in 2008, though in the days before Christmas, Mr. Katz said, some chains discounted more deeply than they should have.

Perhaps the best news is that the double-digit declines that plagued nearly every retailing category last year are gone.

9) Hovde spends many pages (38-43) questioning whether GGP’s Master Planned Community Segment has any value – but Pershing already assigns no value to it so it’s not clear who Hovde is disagreeing with. Another note: on page 39, Hovde makes this ominous statement: “The heirs of the Hughes estate hold a contingent claim related to the valuation of these assets. If there is significant value in these assets, the resolution of this claim could result in a substantial unfunded liability, which Pershing Square has failed to include in its analysis.” This is a red herring: the only claim by the Hughes estate is for half of any profits. Thus, the only way there could be a claim, leading to a “substantial unfunded liability”, is if there are profits, which would be wonderful for GGP (even if GGP only received half of the profits, this is more than zero, which is what both Hovde and Pershing expect).

This is a great debate and it will be very interesting to see how this plays out.

Happy new year to all!

Labels:

Bill Ackman,

General Growth Properties,

GGP,

Hovde,

Mall REITS,

Pershing Square,

REIT,

Short,

Whitney Tilson

Tuesday, December 29, 2009

Hovde's Response To Pershing Square's Response To Hovde's Response To Pershing Square's Views On Mall REITS And GGP Specifically

Well, Hovde seems to be enjoying the publicity that Bill Ackman's Pershing Square is providing them. They have crafted a response to Ackman's response to Hovde's response to Ackman's views (Ackman's prior response linked here).

Whew.

In any case, we think this is one of the healthier debates that exists. Two thoughtful participants going back and forth in a public forum on their in depth views on a business. We honestly look forward to the next volley in the debate - Pershing Square, it's your turn.

Enjoy. [HatTip: BobBob]

General Growth Properties - 2 - Hovde

------------------------------------------

Updated with this Hat Tip video pick from Max Headroom. Cat Fight! Is Hovde the blonde in the pink bra?

Whew.

In any case, we think this is one of the healthier debates that exists. Two thoughtful participants going back and forth in a public forum on their in depth views on a business. We honestly look forward to the next volley in the debate - Pershing Square, it's your turn.

Enjoy. [HatTip: BobBob]

General Growth Properties - 2 - Hovde

------------------------------------------

Updated with this Hat Tip video pick from Max Headroom. Cat Fight! Is Hovde the blonde in the pink bra?

Labels:

Bill Ackman,

Cap Rates,

General Growth Properties,

GGP,

Hovde,

Mall REITS,

Pershing Square,

REIT,

Short

Help Solve The Federal Debt - Timothy Geithner Has It Licked

Good news, the U.S. Treasury has figured out how to solve the problem of runaway deficits (and thus runaway debt and ultimately currency collapse). On the Treasury Direct website, under the FAQ section, you'll find the below gem within the Financing the Debt subheading:

Another gem from the same Financing the Debt subheading is this question:

Phew! Glad we don't have to worry about the debt actually decreasing.

How do you make a contribution to reduce the debt?We're sure that P.O. Box is an extra large, to handle the volume of inbound mail.

Make your check payable to the Bureau of the Public Debt, and in the memo section, notate that it is a Gift to reduce the Debt Held by the Public. Mail your check to:

Attn Dept G

Bureau of the Public Debt

P.O. Box 2188

Parkersburg, WV 26106-2188

Another gem from the same Financing the Debt subheading is this question:

Why does the debt sometimes decrease?What we appreciate most about this is that it's so shocking that the U.S. debt might actually decline that it demands a frequently asked question to reassure people that, no, the debt is not actually declining. It's simply a timing issue on when the Treasury issues and redeems notes.

The Public Debt Outstanding decreases when there are more redemptions of Treasury securities than there are issues.

Phew! Glad we don't have to worry about the debt actually decreasing.

Tuesday, December 22, 2009

Bill Ackman's Pershing Square Rebuts Hovde's Short GGP Thesis

Many of you know that we are fans of Bill Ackman and his firm Pershing Square. We brought you his prior presentation on the attractive economic merits of mall REITS. In response to that presentation and Ackman's prior discourse on why Pershing Square is long General Growth Properties (GGP), Hovde published a bearish response.

Today, we bring you Pershing Square's dismantling of Hovde's response. Enjoy.

As an aside, this has all the makings of a classic cat fight. Purrrrrrr.

A Detailed Response to Hovde's Short Thesis on GGP (12!22!2009)

------------------------------

Updated with this Hat Tip from Max Headroom. Cat Fight! Is Hovde the blonde in the pink bra?

Today, we bring you Pershing Square's dismantling of Hovde's response. Enjoy.

As an aside, this has all the makings of a classic cat fight. Purrrrrrr.

A Detailed Response to Hovde's Short Thesis on GGP (12!22!2009)

------------------------------

Updated with this Hat Tip from Max Headroom. Cat Fight! Is Hovde the blonde in the pink bra?

Labels:

Bill Ackman,

General Growth Properties,

GGP,

Hovde,

Mall REITS,

Pershing Square,

REIT,

Short

Buffett Provides A Video Interview On His Thoughts On the Burlington Northern Business

What follows is the transcript from a recent (12/21/09) Edgar filing from Burlington Northern. It has some illuminating thoughts from Buffett on his expectations from BNI as well as his views on the way America will develop and why BNI is thusly well positioned to benefit. Everything that follows is a cut-and-paste from that filing:

On December 21, 2009, Burlington Northern Santa Fe Corporation (“BNSF”) posted on its intranet a video of CEO Matt Rose interviewing Warren Buffett, CEO of Berkshire Hathaway Inc. (“Berkshire Hathaway”), on matters related to the acquisition by Berkshire Hathaway of BNSF. A transcription of the interview follows:

BNSF VIDEO NEWS

Interview with Warren Buffett

Interviewer: Matt Rose

December 3, 2009

MKR: Hi, I’m Matt Rose. Welcome to this special edition of BNSF Video News. As you all know, we’ve been in the news a lot with the major announcement that we have the future ownership position of BNSF being acquired by Berkshire Hathaway. So I’ve been asked a lot of questions around, what does this mean for BNSF, what does it mean for the individuals that work for BNSF, what does it mean for customers, and what does it mean for the communities in which we operate? And so I thought, who better to ask these questions to than Warren Buffett, chairman, chief executive officer of Berkshire Hathaway. We have a great treat. We’ve got Warren with us today at this taping, so we’re going to get right into it. I’ve asked about 20 people to send in a number of questions, of “ask-Warren” questions, and they did. They sent in about 150 questions. We’re only going to ask about 15 to 20. We’ll see how we do on time. So let’s get right into it. Again, Warren, welcome, thank you for joining us. The first one is, why BNSF, and why now?

WB: Well, uh, you know, I love railroads. I mean, you go back 70 years when I used to be going down to Union Station every Sunday, and so I’ve watched it for years. And, and we couldn’t have done this 20 years ago, in terms of the size of Berkshire. But Berkshire piles up. We don’t pay out any dividends, so we pile up 8 or 9 or 10 billion dollars a year, and, and, you know, this is a dream for me, you know, getting a chance to buy a wonderful railroad like this, and uh, uh, you know, I couldn’t be happier about it.

MKR: So, the next one. In announcing the acquisition, you said it’s an all-in wager on the economic future of the United States. Buffett, who has been building up his rail holdings for several years, said in the statement, I love these events. So would you please just share your perspective and thoughts on the future of the rail industry?

WB: Well, it has to do well if the country does well, and the country is going to do well. So, you know, I don’t know about next week or next month or even next year, but if you look at the next 50 years, this country is going to grow, it’s going to have more people, it’s going to have more goods moving, and rail is the logical way for many of those goods to travel, and probably a greater percentage all the time, just in terms of, of cost efficiency, in terms of fuel efficiency, in terms of environmentally-friendly. So there’s no way rail is going to lose share, and I think the pie is going to grow, and I think the rail share of the pie is going to grow.

MKR: So the next question. You said in the past, you’d rather buy a great business at a fair price than a fair business at a great price. What does BNSF meet the definition of a great business?

WB: Well, it’s a great business in that you know it’s going to be here forever, to start with. I mean, the hula-hoop business came and, you know, went, and then, you know, the pet rocks and all that kind of thing. And even television set manufacturers have, you know, moved over to Japan. All of that sort of thing. The rail business is not going to go anyplace. It’s going to be right here in the United States. There’s going to be four big railroads that are moving more and more goods. So it’s, it’s, it’s a good business. It, it can’t be, it can’t be something like Coca Cola or Google, because it’s, you know, it’s a public service type business, too, and it has, it has a fair amount of regulation that is part of the picture. But it’ll be a good business over time. It will make sense for this country to want railroads to continue to invest more and more money, in terms of expanding and becoming more efficient. So you’re on the side of society, and society will largely be on your side. Not every day, but most of the time.

MKR: Well, I think our 40,000 employees definitely agree with that. Alright, so the next one. Historically, are companies more profitable after joining Berkshire Hathaway, and if so, why?

WB: Well, you can run the business exactly as you see fit. You don’t have to please banks. You don’t have to please Wall Street. You don’t have to, you know, you don’t have to please media or anybody else. Basically, it frees up the managers of our businesses to do exactly what they love to do, which is to run their businesses. And, and, and there’s no home really like Berkshire that can offer that.

MKR: Alright. The next question is, and I didn’t ask this, will Berkshire directly be involved in the management of BNSF, and will the management structure change?

WB: No, it won’t. It’s very simple. We’ve got 20 people in Omaha, and there isn’t one of them that knows how to run a railroad.

MKR: Alright, next question. Will this transaction impact employment levels positively or negatively?

WB: Well, I don’t think it changes anything, really, in that respect. I mean, you’ll be running the railroad, and you’ll run it in an efficient way, and when times are good, you’re going to have more people employed than when times are bad. But nothing in our ownership really has any effect on employment.

MKR: Okay. So, this came from one of our locomotive engineers. He said, will rail labor have access to you regarding issues? How do you balance negotiating fair wages, health care, and a good work environment with Berkshire Hathaway earnings?

WB: Well, you’ll do it just like you’ve managed it in terms of BNSF earnings. And there will be no involvement by me or anybody else in Omaha in terms of labor or in terms of purchasing or in terms of what locomotives you buy, anything of the sort. It’s — we bought it because it was well-managed. If, if, if we had to bring management to BNSF, both of us would have been in trouble.

MKR: Okay. The next question came from our finance group. Will there be a significant, will there be significant BNSF asset sales to pay down the eight-billion-dollar acquisition debt?

WB: Not a dime. Not a dime.

MKR: Next question. Will Berkshire continue to invest the capital needed to maintain the BNSF infrastructure?

WB: Well, it’d be crazy if we didn’t. You know, we’re not going to, we’re not going to buy a business and starve it. You got where you are because you were willing to make the investments ahead of time to pay it off 3, 5, 10 years down the road, and that’s, that’s part of the railroad business, and it’ll stay part of the railroad business.

MKR: You’ve heard me talk about regulatory risk. We’ve been talking to our employees about that for a number of years. And the question is, uh, what’s your perspective on the regulatory risk in our industry, from what you know about it?

WB: Well, Matt, it’ll never go away, in the sense that, people, you know, you will always have people that are bothered by what you’re charging, and you know, whether it’s in some farmer in a pasture or wherever. And the very fact that it has a utility aspect to it. Now it has an entrepreneurial aspect to it, too, but it has a utility aspect to it. So it’s always going to be regulated. There always will be some tension between shippers and railroads, and they will all, there will always be some people who will try and use political influence to affect rates. But in the end, the country needs railroads to spend lots and lots and lots of money merely to stay in the same place, but then beyond that, to grow, and, and it would be crazy of society to deny you a reasonable rate of return.

MKR: Another question from the finance group. Will BNSF capital requests now have to compete internally with other Berkshire interests?

WB: Not in the least. No.

MKR: I thought it was a good question. Okay, next question. In 10 years, how will you evaluate the acquisition of BNSF, whether or not it’s been successful?

WB: Well, I — I’ll measure it against my own standard, which is that I have made a bet on the country doing well. And if I’m wrong on that, that’s my fault and not anybody at BNSF’s fault. But I will look at it how it does compared to other railroads. I’ll look at how railroads are doing versus trucking and all of that. But in the end, I don’t really worry about that very much. I, I’ve seen what’s been done here. I think I know how the country is going to develop. I think the west is going to do well. I’d rather be in the west than the east. So I really don’t have much of a worry about that.

MKR: The next question is, how should be BNSF support the long-term goals of Berkshire Hathaway, and what expectations have you established for the BNSF management team?

WB: You should, you should really be doing it as if you had the same 250,000 owners you have now. I mean, their interests are the same, you know, as Berkshire’s will be, and, and I don’t really see any difference. We want this railroad run as well as it can be. We’d love it every, every, every car you can steal away from the Union Pacific [unintelligible], but we want Union Pacific to do well, too. I mean, we’re both going to do well, too. I mean, we’re both going to do well, you know, in the years ahead. And, and, you know, if we thought it needed changing, we wouldn’t be here.

MKR: Okay, this was a question from one of the employees. I heard Berkshire’s eliminated company-sponsored pension plans at some companies. What are the plans for the BNSF pension plans, and what factors do you take into consideration when evaluating whether to maintain a pension plan at a company you acquire?

WB: Yeah. That will be up to the management. I mean, there may be changes in benefits that the government legislates. I mean, who would have guessed 401K’s would have come along 40 years ago or something of the sort. But you’ll make those determinations just like you make all other determinations.

MKR: BNSF has developed a pay structure that encourages employees to take ownership of the company by basing a portion of the compensation on corporate performance. How will this change after the merger?

WB: Well, the people who have been involved in any kind of a pay-for-performance-type arrangement, whether it’s stock or anything else, will undoubtedly have a pay-for-performance type of compensation, which, you know, you’ll work out, basically.

MKR: Okay, so there were just a lot of questions on your view of the national economy and philosophy around this. A couple of questions. One, it’s been said recently that the rising national debt may be the next economic crisis. Do you agree, and what should be done about it?

WB: Well, I actually wrote an article about that a few months ago. I mean, it is a problem, but if, if you sat down at the start of every year going back to 1776, you could have written down a bunch of problems in the United States. We aren’t perfect at avoiding them, but we’re pretty darn good at solving them. I mean, you know, we’ve even had a civil war in this country, you know, let alone a Great Depression, world wars, and flu epidemics and all that sort of thing. So the country always has problems. The country always solves them. And I don’t know whether business comes back in 3 months or 6 months, but I know this: in the next 100 years, we’re probably going to have 50 bad years, I mean 15 bad years in the United States, and we’re probably going to have, you know, another 15 so-so, and we’ll probably have 70 good ones, something like that. I don’t know the order in which they’re going to come, but overall, this country works. We started out with 4 million people in 1790, and look at what we’ve got now. And it’s because of the system.

MKR: Next question. Do you promote management collaboration among the subsidiary companies?

WB: Yeah, we, we tell them if they can find ways to do things among themselves that benefit both parties, go to it. But we don’t, we don’t force anything through Omaha. We’ve got, for example, a carpet company that worked out something with our insulation company, Johns Manville, in terms of back hauls, for example. And we’ve got other companies cooperated on getting special discounts by buying computers cause of mass purchasing power. But we’ve never ordered anything from Omaha. We don’t convene people to do that or anything. The managers do get to know each other, and sometimes they figure out things to their mutual advantage.

MKR: Okay, the next question is, it’s thought that Berkshire Hathaway has not previously invested in heavily-unionized companies. Given that, what are Mr. Buffett’s views of the role of unions in private-sector businesses generally, and at BNSF in particular?

WB: Yeah, we probably have, I’m sure we have more than a dozen businesses that are, are anywhere from moderately-unionized to very heavily-unionized. The Buffalo News we’ve probably got, I don’t know, 12 or 13 unions. In See’s Candy, we’ve got unions. We’ve got, we’ve got unions at CTB, our farm equipment company. We’ve got lots and lots of unions. And there, you know, we — it’s a question of the industry, to a great extent, and, and uh, and what the management has done in the past, and so on.

MKR: You’ve acquired some terrific private and family-run companies where the owners have great passion for their business. What traits have made those companies so successful, and how can the BNSF family of 40,000 employees apply those principles in our work and lives?